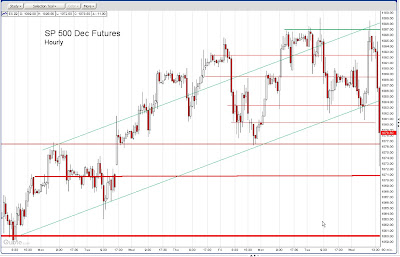

There was tension-driven selling in the markets today despite the 'good news' in the headline economic numbers. The markets are on edge ahead of the ADP and BLS jobs numbers next week. The much touted theory of a 'jobless recovery' is started to show some big holes in credibility, as well it should.

Jobless Recovery

A jobless recovery is nothing more than a euphemism for a monetary asset bubble presenting an ongoing systemic moral hazard.

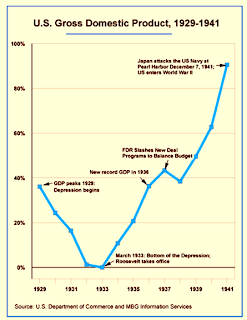

Yes, jobs growth lags GDP in the early stages, everyone knows this. A second year econ student might cite Okun's Law, although it is better called Okun's observation, to show that lag, but it is not relevant to this topic. Beyond early stage lags in the typical postwar recession, a business cycle contraction, what is meant by the jobless recovery is the post tech bubble recovery of 2001-5 wherein jobs growth lagged economic growth in a way we have not seen after any postwar recession, with the median wage never recovering. "Jobless recovery" is a relatively recent phenomenon in the economic lexicon, much younger than 'stagflation' which was thought highly unlikely if not impossible by economists based on their theories, until it happened.

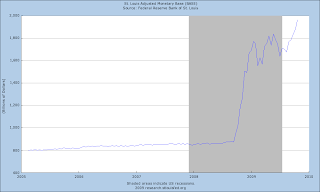

It was the housing bubble and an explosion in unproductive financial activity crafted by the Fed and the Wall Street banks that provided the appearance of economic vitality in 2001-7. It was no genuine recovery despite the nominal GDP growth. It indicates a need to deflate the growth numbers more intelligently, if not more honestly, and future economists are likely to 'discover' this, although John Williams of Shadowstats has done a good job of demonstrating the distortions that have crept into US economic statistics. The tech bubble was perhaps an unfortunate response to the Asian currency crisis and fears of Y2K. What was done to promote recovery from the tech collapse and create the housing and derivatives credit bubble was pre-meditated and criminal.

The current state of economics is most remarkable for its arrogant complacency in the face of two failed bubbles, a near systemic failure, a pseudo-scientific perversion of mathematics exposed, and an incredible capacity for spin and self-delusion. The people wish to believe, and Wall Street and the government economists are all too willing to tell them whatever they wish to hear, for a variety of motives. And there is an army of salesmen and lobbyists and econo-whores touting this fraud around the clock.

The Failure of Financial Engineering

The next bubble should provide the coup de grâce when it fails, although the fraudsters might try and spin ten years of a stagflationary economy as 'the new normal.'

There are good reasons for this failure of American "monetary capitalism," and it has to do with an oversized financial sector and a surplus of white collar crime that both distort and drain the productive economy. The current approach is to pump money into a failed system without attempting to reform it, to fix its fundamental flaws, to make an honest accounting of the results. The result are serial bubbles and the foundation for long duration zombie economy with a grinding stagflation that may morph into a currency crisis and the fall and reissuance of the dollar, as we saw with the Russian rouble. It will stretch the political fabric of the US to the breaking point. This is how oligarchies and their empires fall.

CIT Staggers Into Bankruptcy

Trader confidence was shaken by more indications that business lender CIT will declare a preplanned bankruptcy next week.

Approaching Crash in Commercial Real Estate

Also roiling the markets was a shocking warning by billionaire Wilbur Ross of an approaching meltdown in the Commercial Real Estate market which has been anticipated and warned about by non-shill market analysts.

Gold Holds Steady

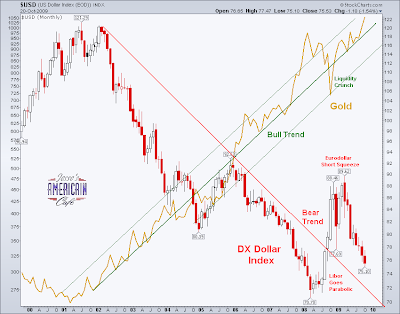

Gold showed a remarkable resilience today against determined short selling in the paper Comex markets. Here is a decent summary of the case that the gold bulls have been making, in addition to the standard observations about dollar weakness. Gold Bullion Market Reaching the Breaking Point

Bank Failures Hit 115

Meanwhile, nine more commercial banks rolled over this week. Calculated Risk reports that the unofficial FDIC list of problem US banks now numbers 500.

Here is the list from FDIC of all Official US Bank Failures since 2000.

All of the nine banks were taken over by the US Bank National Association (US Bancorp), and were part of the FBOP company in Oak Park, Illinois, one of the largest privately held bank holding companies in the US. It is reported that all nine were heavily invested in real estate lending.

California National is the fourth largest bank failure this year. It lost about $500 million on heavy investments in Fannie Mae and Freddie Mac preferred shares, in addition to overwhelming losses in California real estate.

North Houston Bank, Houston, TX, with approximately $326.2 million in assets and approximately $308.0 million in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

Madisonville State Bank, Madisonville, TX, with approximately $256.7 million in assets and approximately $225.2 million in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

Citizens National Bank, Teague, TX, with approximately $118.2 million in assets and approximately $97.7 million in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

Park National Bank, Chicago, IL, with approximately $4.7 billion in assets and approximately $3.7 billion in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

Pacific National Bank, San Francisco, CA, with approximately $2.3 billion in assets and approximately $1.8 billion in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

California National Bank, Los Angeles, CA, with approximately $7.8 billion in assets and approximately $6.2 billion in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

San Diego National Bank, San Diego, CA, with approximately $3.6 billion in assets and approximately $2.9 billion in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

Community Bank of Lemont, Lemont, IL, with approximately $81.8 million in assets and approximately $81.2 million in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)

Bank USA, National Association, Phoenix, AZ, with approximately $212.8 million in assets and approximately $117.1 million in deposits was closed. U.S. Bank National Association, Minneapolis, MN has agreed to assume all deposits. (PR-195-2009)